La Foncière Citoyenne et Sociale

GIVE YOUR INVESTMENTS A SOCIALLY RESPONSIBLE DIMENSION

ESUS approval no. 2022-01

Eligible for the Madelin law, allowing tax optimisation of 25%.

MAIN CHARACTERISTICS

LEGAL FORM OF THE COMPANY | Public limited company with variable capital |

ISIN CODE | FR0013179785 |

OPENING OF SUBSCRIPTIONS | from 22nd november 2023 to 21st november 2024* |

MAXIMUM AMOUNT OF CAPITAL INCREASE | 7 990 980 €, i.e. 133 183 shares (nominal value + issue premium) |

MINIMUM SUBSCRIPTION AMOUNT | 4 800 € (share at €60) |

TARGET TRI | 5.40% p.a.* with a target dividend payout of 1.5% p.a. from the third year onwards |

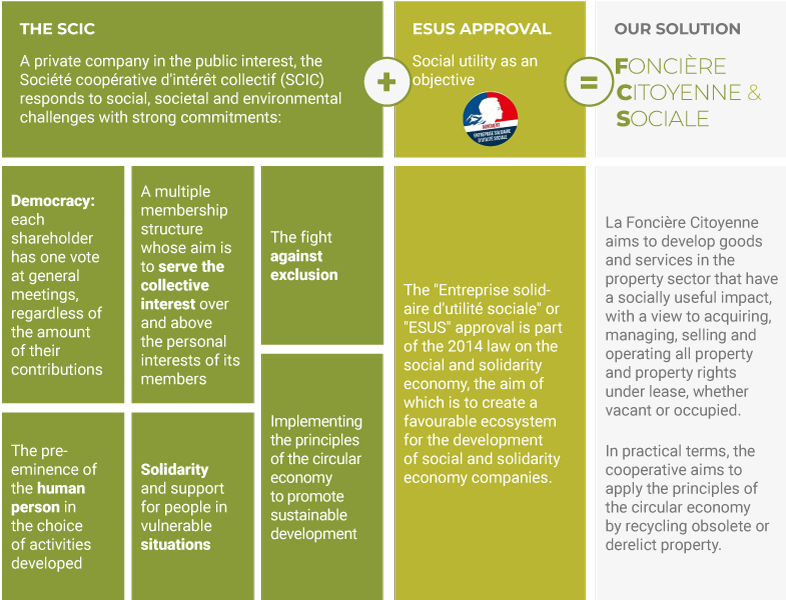

INVESTMENT STRATEGY | La Foncière Citoyenne aims to develop goods and services in the property sector that have a socially useful impact, with a view to acquiring, managing, selling and operating all property and property rights under lease, whether vacant or occupied. |

TAX ELIGIBILITY |

*The Company draws investors' attention to the fact that their specific situation should be examined with their usual tax advisor. |

THE MANAGEMENT COMPANY

MAXIMISING SOCIAL AND CIVIC BENEFITS

CONSTANT INNOVATION AT THE SERVICE OF HOUSING

|

2015

|

Commercial launch of a vehicle approved as a socially responsible company (ESUS approval)

|

|

2016

|

Launch of the Portfolio Management Company

|

|

2018

|

Memberships of the Responsible Investment Forum (FIR) and the Principles for Responsible Investment (PRI)

|

|

2019

|

Launch of the 1st Impact Investing bond fund dedicated to residential property

|

|

2020

|

PRI rated A for governance and B for real estate

|

|

2021

|

100% of projects financed have been integrated into an ESG approach

|

|

2022

|

Launch of Foncière Citoyenne et Sociale

|

The service providers on which the Company and the project companies may rely in the context of their operations, particularly in terms of development and communication, may be members of the Horizon group. In order to manage as effectively as possible the potential risks of conflicts of interest resulting from this situation, Horizon AM has created a procedure relating to the prevention of conflicts of interest, detailing the measures taken during the selection of service providers and providing for Horizon AM's service providers to be put out to tender so that they are not necessarily members of the Horizon Group.

KEY FIGURES FOR HORIZON AM

Partners

investors

inflow***

financed

financed

generated (forecast)

THE COMPLEMENTARY NATURE OF EXPERT PROFESSIONS

|

REAL ESTATE DEVELOPMENT

|

Responding to the housing shortage

|

|

PROPERTY REHABILITATION

|

Revitalising obsolete assets

|

|

URBAN PLANNING

|

Designing the city of tomorrow

|

… IN A WORLD OF SOCIAL IMPACT REAL ESTATE

|

COLIVING RESIDENCE

|

Optimising space for harmonious community living

|

|

NURSING HOME

|

Fighting medical desertification in the regions

|

|

SERVICED

RESIDENCE |

Extending independence with integrated services

|

|

SEPARATION OF BARE OWNERSHIP

|

Developing social housing

|

|

SUBSIDISED

HOUSING |

Reducing inadequate housing in large cities

|

LA FONCIÈRE CITOYENNE ET SOCIALE

THE MERGER OF ESUS AND SCIC FOR A SHARED AMBITION

THE OBJECTIVES OF THE SOCIALLY RESPONSIBLE PROPERTY COMPANY

- Promoting the social integration of socially vulnerable people

- Fighting medical deserts and promoting local access to care

- Promoting the preservation of rural heritage

- Promoting access to social housing

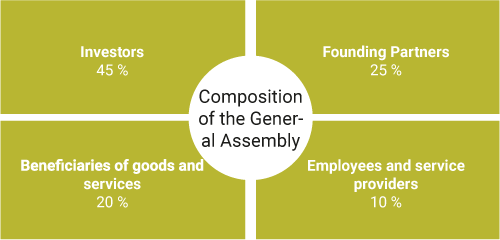

A WIDER PANEL OF DECISON-MAKERS

- Each shareholder has one vote in his voting group

- Everyone votes in their own electoral college

- Each college has a voting share

- Each shareholder has one vote, irrespective of the amount of their financial contribution, at General Meetings.

A SPECIFIC DISTRIBUTION MECHANISM

SHARING THE SCIC'S PROFITS

At the end of the financial year, if the SCIC has made a profit, the AGM will distribute this profit. Part of the profits will be kept in the cooperative in the form of non-shareable reserves.

The SCIC allocates at least 57.5% of its profits to reserves that cannot be shared out, although this rate may be increased to 100% by each AGM or by the Articles of Association. The balance (a maximum of 42.5% of profits) may be allocated, with a ceiling, to the remuneration of members' shares after deduction of any public aid.

Non-distributable reserves are made up of two types of reserves :

- The legal reserve: the SCIC allocates at least 15% of its profits to this reserve until the amount of the reserve is at least equal to the share capital.

- Statutory reserve: once the legal reserve has been set up, the SCIC pays out a minimum of 50% of the balance of the result.

With regard to the remuneration of SCIC shares, the rate of remuneration is at most equal to the average, over the three calendar years preceding the date of the General Meeting, of the average rate of return on private company bonds (TMO), plus two points.

With regard to non-divisible reserves, the Articles of Association stipulate that in the event of a decision to cease trading, the liquidation surplus is allocated to a structure with a similar corporate purpose.

TRANSFER OF SHARES

Transfers of shares in SCICs are made at par value.

THEMES WITH A STRONG SOCIAL IMPACT

OPTIMISING SPACE FOR HARMONIOUS COMMUNITY LIVING AM

Coliving is a promising residential concept, somewhere between managed and open-plan housing. The "co" meaning "together" and "living" meaning "living", can be broken down into 3 approaches depending on the typology of the players and those of the underlying assets: residential coliving, multi-cell coliving and shared coliving.

DESIRED IMPACTS

- Promoting social integration

- Reducing exclusion

- Promoting access to higher education and/or employment

TARGET AUDIENCE

- Single-parent families

- Low-income and vulnerable populations or those on the verge of social decline

- Low-income students with no access to housing in areas with high rental pressure

EXAMPLE IN PARIS XIV COLIVING REFURBISHMENT

Located in the popular Alésia district, the residence benefits from a lively environment and the dynamic Avenue du Général Leclerc. It is also within easy reach of the Alésia and Porte d'Orléans stations (line 4), as well as Montparnasse station.

The project comprises 15 private bedrooms or studios, a kitchen, a living room, a games and relaxation room and a landscaped garden.

COMBATING MEDICAL DEPOPULATION IN THE REGIONS

Horizon AM provides effective, practical solutions to combat territorial inequalities in access to healthcare. For each project, a full diagnostic is carried out based on a study of medical demographics and a feasibility audit.

DESIRED IMPACTS

- Promoting social integration

- Promoting access to local healthcare

- Fighting against medical desertification

- Promoting access to higher education and/or employment

TARGET AUDIENCE

- Inhabitants of rural areas

- Senior citizens

- People in vulnerable situations

EXAMPLE IN ST-GERMAIN-LÈS-CORBEIL (91) CONSTRUCTION OF A MEDICAL CENTRE

The 3-storey health centre will be fully accessible to people with reduced mobility (PRM). It will house a medical, dental, paramedical and physiotherapy centre, as well as a medical analysis laboratory and a pharmacy. This project will help people in vulnerable situations to maintain their independence and optimise their access to medical services.

INCREASE THE NUMBER OF COLLECTIVE CHILDCARE SOLUTIONS FOR YOUNG CHILDREN

Horizon AM provides effective, practical solutions to combat territorial inequalities in access to healthcare. For each project, a full diagnostic is carried out based on a study of medical demographics and a feasibility audit.

DESIRED IMPACTS

- Increase in capacity

- Reduce the use of parental leave by mothers who are furthest from the labour market

- Diversification of collective childcare facilities for young childrent

TARGET AUDIENCE

- Young and future parents, living in rural, urban or peri-urban areas where childcare is a necessity

- Single-parent families

EXAMPLE IN ORRY-LA-VILLE (60) REFURBISHMENT OF A CHILDREN'S CENTRE

This operation involves the acquisition of a derelict building after renovation. The project is in line with the principles of the circular economy. As part of the project, a multiservice centre comprising a micro-creche and a Montessori school has been created. The Company will acquire the building and operate it through leases with the micro-creche and the Montessori school.

DEVELOPING SOCIAL HOUSING

Horizon AM has developed expertise in bare ownership stripping for social landlords, enabling them to gain access to a high-quality stock of social housing.

DESIRED IMPACTS

- Promoting social integration

- Facilitating access to social housing for people on modest incomes

- Reducing exclusion

TARGET AUDIENCE

- Low-income and vulnerable populations or those on the verge of social decline

- Single-parent families

- Low-income students

EXAMPLE IN NICE (06) HOUSING DEVELOPMENT

The operation involves financing and acquiring housing, and then transferring the usufruct of the property to social landlords. The latter will be responsible for renting the properties to low-income households. Rental under this scheme will be reserved for households on a means-tested basis, at social rents.

THE FISCAL FRAMEWORK

REDUCE YOUR INCOME TAX

SCICs are subject to corporation tax under ordinary law. However, sums allocated to non-distributable reserves are deductible from the basis for calculating corporation tax. This deduction is made in respect of the financial year in which the profits for the previous financial year are set aside. The deduction thus made is definitive.

RISKS FACTORS

Risk of partial or total loss of investment, as with any investment in the capital of a company. The Chair considers that the risk of capital loss is mitigated by the fact that the capital subscribed to is invested mainly in building land and buildings. Land and property are real assets, which are not susceptible to speculation. The buildings themselves are acquired at well below market value, and this discount represents a solid guarantee for the Company's financial structure. As a result, the business model ensures that the risk of capital loss is well managed.

The diversification of investments (both in terms of number and geographical sectors) may be reduced, as it depends on the amount of capital subscribed. This is why the Company intends to maintain its policy of diversifying its investments.

The Company will acquire assets that it will operate by letting them. In view of this activity, the Company is subject to a risk linked to the terms and conditions of the leases, the level of rents it will receive and the vacancy rate of the premises.

Subscribers are free to sell their shares. The terms and conditions of the right of withdrawal are set out in the Articles of Association in Article 11 "Transferability - Transfer of shares". Investors should note that their withdrawal request may not be executed in full and that the liquidity of their shares is not fully guaranteed. The Chair wishes to point out that the recommended minimum holding period for shares is 7 years.

The property market does not evolve with any certainty and, in the event of a crisis, the Company may find itself unable to disinvest from projects in which it has invested. We can reasonably adjust our development plan.

It is possible that the Company could make an erroneous estimate of its forecast costs, which could reduce the profitability of projects. However, in the event of a modelling error or a reduction in commercial margins, this performance could fall significantly. However, it will remain superior to conventional performance.

In view of the financial size of the projects in which the Company wishes to invest and the operating costs and expenses, the Company may borrow or co-invest with Horizon Group companies or renowned developers. Borrowing will be at market rates and conditions. However, there is a risk that the Company will not complete its investment(s) if it does not obtain bank financing. If necessary, the investment(s) may be made by other Horizon Group companies.

The Company obtained approval as a socially responsible enterprise in June 2022, for a period of five years. At the end of this period, renewal of the approval may be requested. There is a risk that renewal may be refused, or that ESUS approval may be withdrawn.

- Risk of the issuer failing to redeem shares at their par value

- Risk linked to financial and political rights that differ from those of other members

- Net asset value risk

- Risk related to the limitation of voting rights linked to the issuer's cooperative status

THE REGULATORY FRAMEWORK

The Summary Information Document (DIS) relating to this public offering of shares issued by Foncière Citoyenne & Sociale ("FCS" or the "Issuer"), acting as an Other FIA, has been filed with the AMF, in its capacity as competent authority under Regulation (EU) 2017/1129. The DIS has been filed with the AMF, which verifies that the information contained in the DIS is complete, consistent and understandable within the meaning of Regulation (EU) 2017/1129. This filing should not be considered as a favourable opinion on the issuer and on the quality of the shares that are the subject of the DIS and does not imply either approval of the appropriateness of the transaction or authentication of the accounting and financial information presented. The DIS was filed on 15 November 2022. The shares offered to the public are not financial securities. The specificities resulting from this, as well as the specificities resulting from the cooperative status of the company, are described in detail in the DIS. Investors are invited to read it before making an investment decision, in order to fully understand the potential risks and benefits associated with the decision to invest in the shares of a cooperative society.

The risks associated with this operation are set out in the "Risk factors" sections of the DIS, in particular one relating to the return on shares. The return on shares, which must be subscribed at their nominal value, is limited and governed by law. It is up to each investor to check whether it is worth investing in FCS. The product is not simple and may be difficult to understand. Copies of the DIS are available free of charge at the Company's registered office (21 B rue Jacques Cartier, 78 960 Voisins-le-Bretonneux), at Horizon AM's sales office (15 rue Cortambert, 75116 Paris) and on the AMF (http://www. amf-france.org) and Company websites.

The risk factors are set out in the DIS and summarised on page 2 of the sales brochure. The Company will not be able to take up subscriptions made by investors before 31 December of the seventh year following the year of subscription.

The Company is a public limited company (SCIC) administered by a Board of Directors. The Company has appointed HORIZON AM as its management company and delegated the management of its investments to it. It is in this capacity that HORIZON AM acts.

(1) The lowest category does not mean "risk-free".

DOCUMENTATION

REPORTING

SUBSCRIPTION PROCEDURE

Investors must send their complete application documents to :

HORIZON AM

Back Office service

15 rue Cortambert

75116 PARIS

THE COMPLETE FILE INCLUDES THE FOLLOWING ELEMENTS

| THE ORIGINAL DOCUMENTS DULY COMPLETED, DATED AND SIGNED BELOW :

- Subscription form in 3 copies

- Customer knowledge sheet

- Identification of the investor

- Declaration of origin of funds

| SUPPORTING DOCUMENTS TO ENCLOSE WITH THE APPLICATION :

NATURAL PERSONS

- Recto/Verso valid identity document (2 documents for French residents of foreign nationality)

- Proof of residence less than 3 months old (bill: landline telephone, gas, water, etc.)

- Subscriber's bank details

- Proof of origin of funds

- Cheque or transfer order

- For PEA/PEA-PME-ETI: transfer order from the cash account

LEAGAL ENTITIES

- Up-to-date company articles of association signed by the legal representative

- Kbis dated less than 3 months

- Company bank details

- Recto/Verso identity document of the legal representative

- List of persons authorised to act on behalf of the company with their powers and example of signature

- Proof of origin of funds

- Cheque or transfer order

Subject to a complete and regular application file, Shares will be allocated to subscribers on a "first come, first served" basis. The date of receipt by the Manager of a complete subscription file shall be deemed to be the order of arrival of subscriptions. In the event of an incomplete application, the date of receipt will be deemed to be the date of receipt of all missing elements. Once a complete application has been received, the Manager will acknowledge receipt by sending the Subscriber proof of receipt within 15 days.

| PROSPECTUS AVAILABLE FREE OF CHARGE

- On the company's website or via the link: https://www.horizon-am.fr/doc/dis_scic.pdf

- Know your client data sheet

- At the head office (21 B rue Jacques Cartier, 78960 VOISINS-LE-BRETONNEUX) and at the Manager's commercial office (15 rue Cortambert, 75116 PARIS)

- On the AMF's website

Information request

I already have a financial investment adviser

I do not have a financial investment adviser

Press room

Management policy

Regulations

HORIZON AM

Sales office : 39 rue de la Saussière 92100 Boulogne-Billancourt

Head office : 21 rue Jacques Cartier 78960 Voisins-le-Bretonneux

Tèl : 01 73 00 59 20

Société de Gestion de Portefeuille agréée par l’AMF sous le N° : SG-16000018 en date du 24/06/2016

HORIZON AM

Sales office : 39 rue de la Saussière 92100 Boulogne-Billancourt

Head office : 21 rue Jacques Cartier 78960 Voisins-le-Bretonneux

Phone : 01 73 00 59 20

Portfolio Management Company approved by the AMF under No. : SG-16000018 dated 24/06/2016